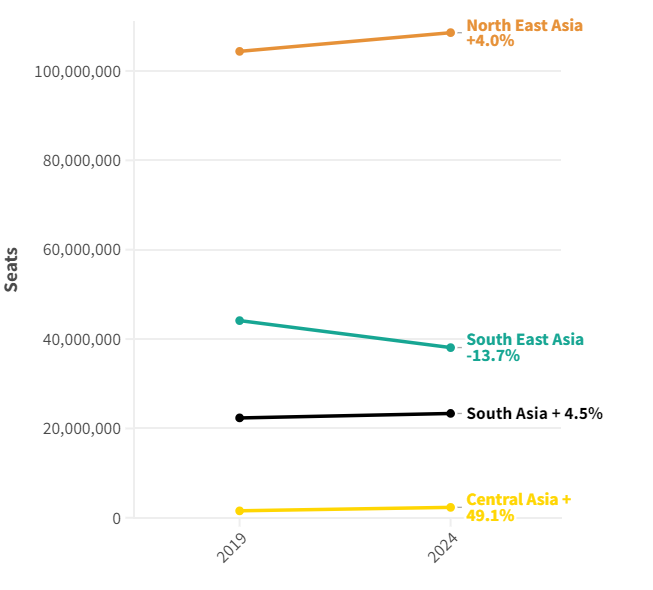

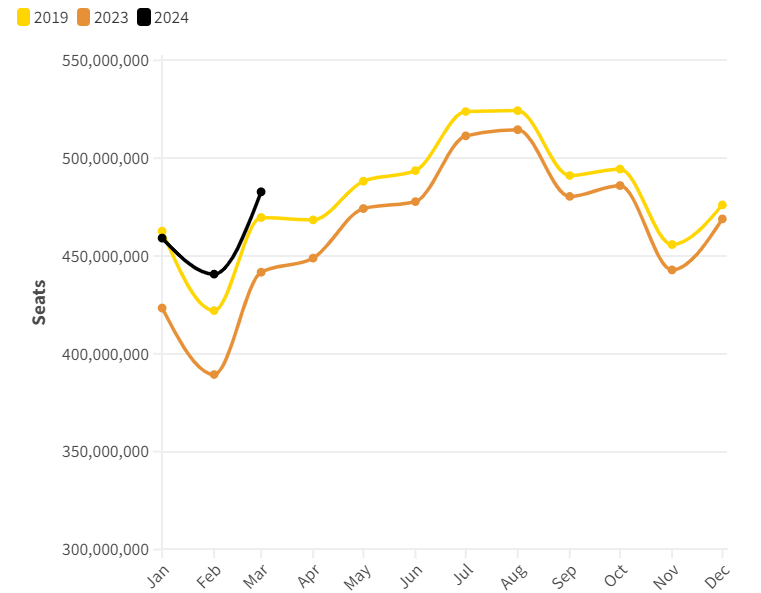

ASIA- China made headlines globally when it declared the reopening of its borders on January 8, 2023. However, one year later, Chinese international capacity remains 30% below the levels seen in Q1 of 2019, and even upon reaching that milestone, there will still be a need to recover four years’ worth of lost capacity and demand growth.

Market dynamics have shifted throughout this period, with Chinese outbound travel influenced by various demand and supply factors.

China’s Aviation and Outbound Tourism Surge (2010-2019)

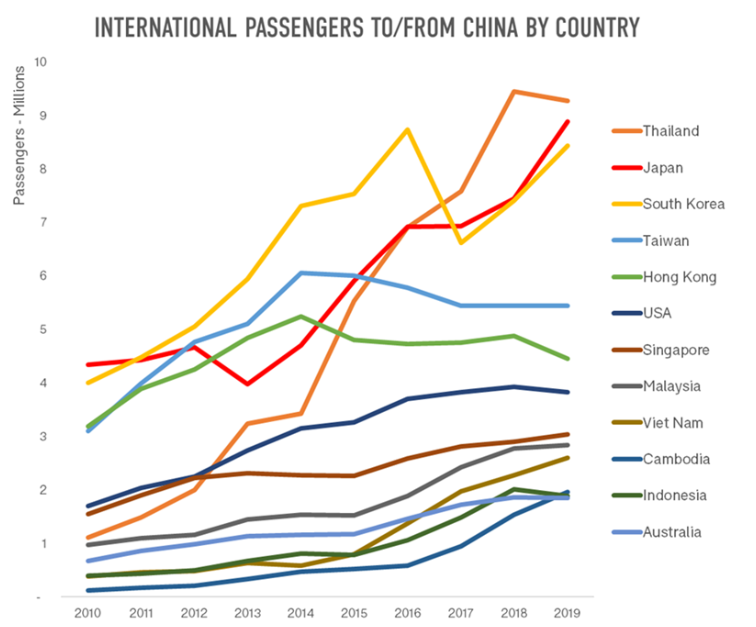

In 2010, a total of 56 million air passengers traveled to/from China, a number that surged to 147 million by 2019. During the period from 2010 to 2019, this growth roughly translated to:

- An increase of approximately 60 million passengers traveling between China and North-East Asia,

- 19 million more passengers to/from South-East Asia,

- 4 million to/from Europe,

- Three million to/from North America and the South-West Pacific region.

Chinese outbound tourists are known as the biggest spenders globally, with their expenditure reaching USD 254 billion in 2019 (of which USD 152 billion was attributed solely to the US-China visitor market). Consequently, fierce competition exists within the Chinese outbound market.

Between 2010 and 2019, international passenger numbers grew at an average rate of 11.2%, with even more rapid growth observed in certain Southeast Asian destinations: 27% to Thailand, 37% to Vietnam, and 19% to Indonesia. While less than 10% of Chinese citizens currently possess a passport, the issuance of 10 million new passports annually in 2019 suggests significant untapped potential demand.

Overview of Chinese Tourism Trends in Asia

In 2023, Thailand’s tourism authority recorded 3.5 million Chinese tourists, aiming for 8.2 million in 2024, compared to 11 million in 2019.

Cambodia anticipates reaching 700,000 Chinese tourists in 2023, targeting 1 million thereafter.

Australia welcomed 1.4 million Chinese visitors in 2019, with statistics from January to September 2023 reporting just under 0.5 million.

Indonesia saw 570,000 Chinese tourists from January to September 2023, significantly lower than the 2.07 million achieved in 2019. Projections for 2024 aim to return to 2019 levels.

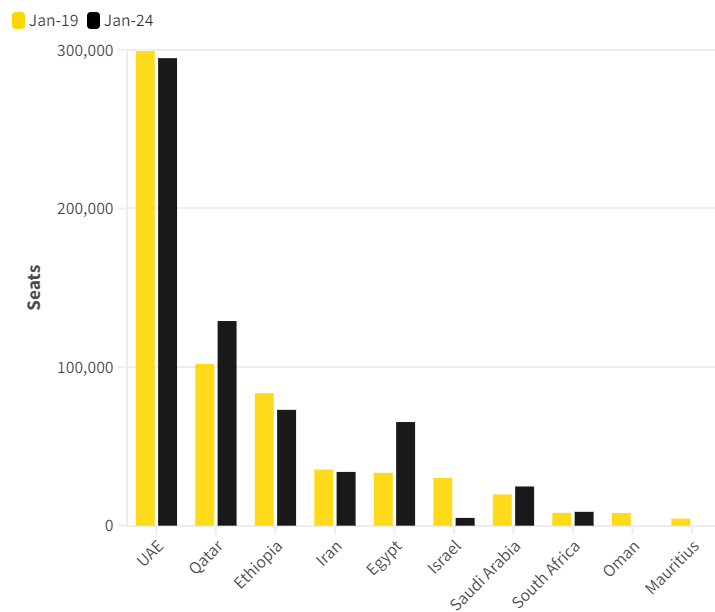

Steady growth and recovery are expected in Asia’s Chinese tourism markets. However, South-East Asian tourist destinations must differentiate their offerings to remain competitive. As part of its Vision 2030, Saudi Arabia targets 5 million Chinese tourists by 2030, up from 100,000 in 2023. The flight time from Shanghai to Riyadh is 12 hours 30 minutes, compared to Shanghai to Sydney, which is 10 hours 30 minutes, making it a potential competitor market.

Chinese Airlines’ Growing Influence on International Air Travel

The proportion of international capacity to and from China operated by Chinese carriers is rising, currently standing at 63%, up from 47% in January 2023 and 53% in January 2019. In China’s Top 10 outbound markets, the capacity share operated by Chinese-domiciled carriers has increased across every country.

The three major airlines, namely China Southern, China Eastern, and Air China, have boosted their international share from 60% in 2019 to 64% presently. However, they encounter the challenge of meeting the growing demands for both domestic and international capacity.

Additionally, the geopolitical situation in Ukraine is impacting the return of European and North American carriers to the Chinese market. These carriers prefer facilitating their alliance partners’ operations in China rather than bearing the additional flight time and costs associated with circumventing rather than traversing Russian airspace.

China’s Open Visa Policy

Acknowledging the necessity of eliminating barriers and simplifying procedures to invigorate the tourism sector, China has adopted a notably more open approach to visas. The visa landscape is evolving swiftly: in late 2023, China introduced visa-free travel for a year for five European countries and Malaysia. Efforts have also been made to streamline tourist visa processes for US citizens visiting China.

Discussions between China and Singapore have commenced to institute a visa-free policy, expected to be effective in early 2024. These mutual visa arrangements underscore that China has become increasingly accessible.

Collaborative Strategies For Tourism Growth

Tourism authorities must prioritize marketing strategies and collaborate with industry partners to offer appealing products at competitive prices. Saudi Arabia, for instance, is making substantial investments in targeting Chinese travelers through collaborative marketing initiatives with China-based Trip.com.

Partnering with tour operators can facilitate the promotion of new destinations. While there’s a need to increase capacity to meet ambitious targets, it’s evident that this sector will experience significant growth in the future.

The upcoming Chinese New Year holiday is expected to witness a surge in travelers, thanks to an extended break and newfound visa flexibility, making it an opportune time to travel from China. We eagerly anticipate observing which destinations will be favored this year and extend warm holiday wishes to our readers in China.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News.