The launch of 2 new airlines, Akasa and Jet Airways 2.0, early next year is anticipated to possess an on the spot impact on air fares in bound sectors, tho’ it’s possible to disrupt the market solely within the next 2 to 3 years once these airlines increase their scale, trade consultants same.

SNV Aviation, that is backed by have Rakesh Jhunjhunwala and can operate ultra-low-cost airline Akasa, has placed AN order for seventy two Boeing 737-8 grievous bodily harm craft for $9 billion, paving the means for the airline’s summer 2022 launch.

“Akasa is anticipated to disrupt the affordable carrier market, that is junction rectifier by IndiGo however solely once reaching substantial scale.

Within the short term, the airline, that is well-funded, could cause a churn in high talent within the trade and impact air fares on bound sectors,” same a senior official with a Gurugram-based airline, WHO spoke on the condition of namelessness.

“Akasa’s entry could cause disruptions almost like those caused by coraciiform bird Airways once its launch in 2005-06 once the market was dominated by full-service carriers,” the official same.

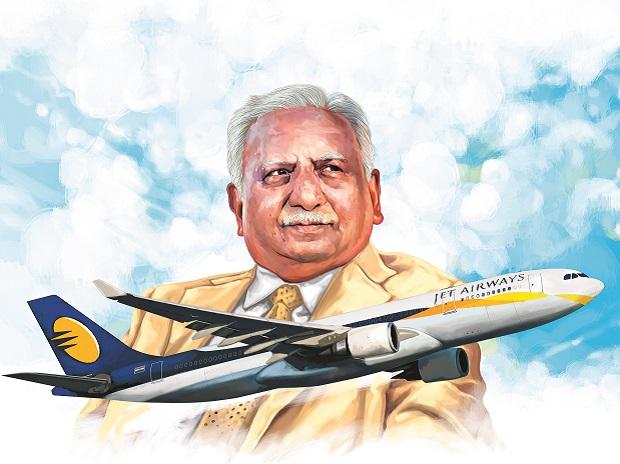

Jet Airways two.0 is probably going to launch by early next year, with its new promoters hoping to induct as several as fifty craft within the next 3 years.

“The inhibited demand can still grow and therefore the new players getting into the market can usher in a lot of advantages and choices to travellers,” same Nishant Pitti, corporate executive and co-founder of on-line travel company EaseMyTrip.com.

“The market can become a lot of dynamic in terms of costs and offers that may more facilitate in reaching the pre-pandemic level quickly,” he said.

It must, however, be noted that each Akasa and Jet Airways 2.0 can realize it tough to induce prime slots at busy airports like urban center right away once their launch. This successively could create it tough for them to vie with incumbents on busy routes like Mumbai-New Old Delhi.

Aviation practice Capa Republic of India expects Akasa to disrupt the market solely by FY25, once it reaches scale and achieves a competitive value base.

However, Tata Group’s acquisition of Air Republic of India and therefore the entry of 2 new players can see airlines fight to retain talent and IndiGo is anticipated to face important impact on this front, Capa Republic of India same in its recently discharged FY22 mid-year outlook.

“Since, the launches (of Akasa and Jet Airways two.0) area unit happening within the aftermath of covid, one will expect certain quantity of maturity and balance in valuation within the market,” same Mark Martin, chief government of Martin Consulting LLC.

“However, the new entrants are going to be getting into a market dominated by 2 players, IndiGo and Tata cluster airlines (Air Republic of India, Vistara and AirAsia India) and is probably going to fire up competition within the end of the day.”

Market leader IndiGo, that has concerning 278 craft in its fleet, commands a market share of concerning fifty 3.5%, as of October 2021.

Tata Group, that won the bid for Air {india|India|Republic of Republic of India|Bharat|Asian country|Asian nation} and its affordable subsidiary Air India categorical, is anticipated to achieve management of those airlines by December-end. this can leapfrog the Tata cluster to the position of the second-largest airline player within the market with a combined market share of 25-30%.

Spokespersons of IndiGo, SpiceJet, Air India, Vistara, GoFirst and AirAsia Republic of India didn’t reply the story.