SEATTLE- The Boeing Company (NYSE: BA) has reported first quarter revenue of $19.5 billion, reflecting 130 commercial deliveries, with a GAAP loss per share of ($0.16) and core loss per share of ($0.49). The aerospace giant’s 737 production gradually increased during the quarter.

The company reported operating cash flow of ($1.6) billion and free cash flow of ($2.3) billion, showing improvement over 2024 figures. Total company backlog grew to $545 billion, including over 5,600 commercial airplanes, demonstrating continued market confidence.

Boeing Reports First Quarter (Q1) Results

Boeing’s first quarter results for 2025 indicate positive momentum as the company works to address ongoing challenges. Revenue increased 18% to $19.5 billion compared to $16.569 billion in the first quarter of 2024, primarily driven by higher commercial airplane deliveries.

The net loss narrowed significantly to $31 million from $355 million a year earlier, reflecting improved operational performance across business segments.

The Commercial Airplanes division posted revenue of $8.1 billion with an operating margin of (6.6%), a substantial improvement from the (24.6%) margin in the same period last year.

The 737 program is gradually increasing production with plans to reach 38 aircraft per month by the end of the year, with CEO Kelly Ortberg indicating the company is preparing to seek FAA approval to increase production to 42 aircraft monthly later in 2025.

Boeing’s 787 Dreamliner program maintained stable production at five aircraft per month with plans to increase to seven monthly this year. Meanwhile, the 777X program began expanded FAA certification flight testing, keeping on track for the first 777-9 delivery in 2026.

Defense and Services Segments

The Defense, Space & Security segment reported $6.3 billion in first quarter revenue with an operating margin of 2.5%, showing slight improvement from 2.2% in the previous year.

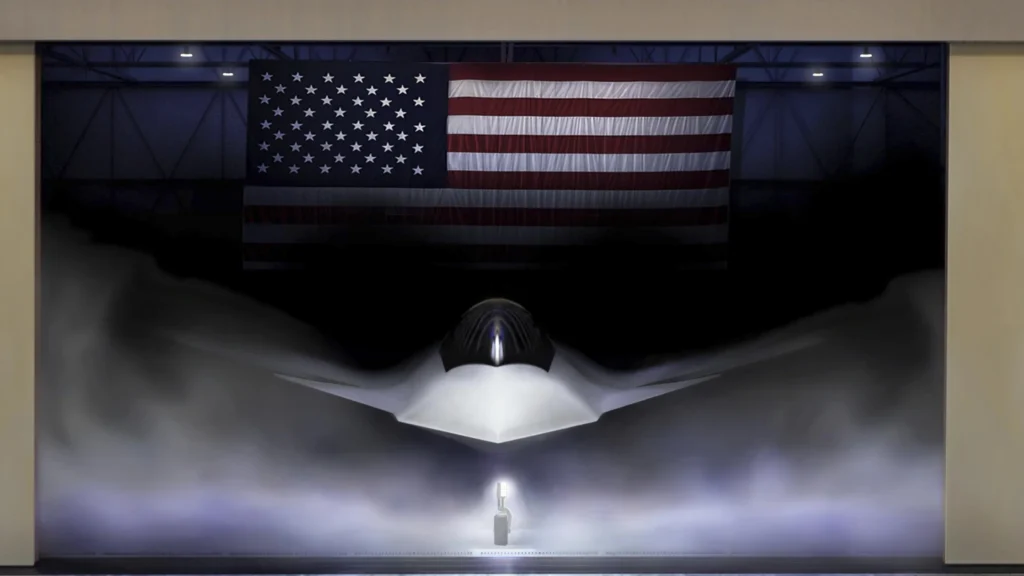

A significant development during the quarter was Boeing’s selection by the U.S. Air Force for a contract to design, build and deliver the F-47, its next-generation fighter aircraft.

Global Services maintained steady performance with quarterly revenue of $5.1 billion and an operating margin of 18.6%, up from 18.2% year-over-year. Notable achievements included delivering the 100th 767-300 Boeing Converted Freighter to SF Airlines (CSS) and securing a modification contract from the U.S. Air Force to integrate electronic warfare systems for the F-15 Eagle.

Cash Position and Market Outlook

Boeing’s cash and investments in marketable securities totaled $23.7 billion at quarter end, compared to $26.3 billion at the beginning of the quarter. Total debt decreased slightly to $53.6 billion from $53.9 billion. The company maintains access to $10 billion in undrawn credit facilities.

Commercial Airplanes booked 221 net orders during the quarter, including significant deals with Korean Air (KE) and BOC Aviation. The company’s strong backlog of over 5,600 commercial airplanes valued at $460 billion provides stability amid market uncertainties.

“Our company is moving in the right direction as we start to see improved operational performance across our businesses from our ongoing focus on safety and quality,” said Kelly Ortberg, Boeing president and chief executive officer. “We continue to execute our plan, are seeing early positive results, and remain committed to making the fundamental changes needed to fully recover the company’s performance while navigating the current environment.”

Global Trade Challenges and Future Outlook

Boeing faces potential headwinds from global trade tensions, with the company noting that current results only reflect tariffs enacted as of March 31, 2025. The manufacturer is monitoring developments in the ongoing trade war, which could increase prices for aircraft and imported parts.

Despite these challenges, Boeing’s leadership remains optimistic based on strong aircraft demand and the company’s substantial backlog.

In April, Boeing announced an agreement to sell portions of its Digital Aviation Solutions business, with the transaction expected to close by the end of 2025, subject to regulatory approval.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on the Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News