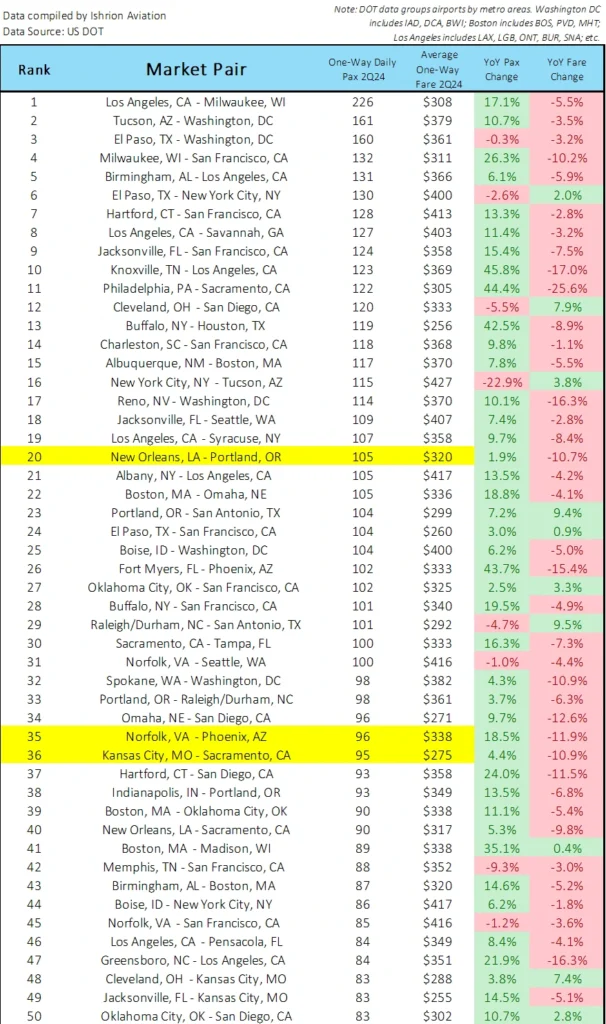

Ishrion Aviation analyzed US Department of Transportation (DOT) data from Q2 2024 to identify the 100 busiest unserved city pairs in the contiguous U.S. These city pairs have the highest number of daily passengers and lack direct flights, highlighting potential opportunities for new non-stop routes.

The analysis also includes the average fare paid by passengers who currently connect through other airports to complete their journeys.

100 Unserved Routes in the US

The list focuses on unserved markets in the contiguous U.S., excluding Hawaii and Alaska. Key data points provided for each city pair include:

- One-Way Daily Pax 2Q24: The average number of passengers traveling daily between each origin and destination in each direction. This metric only includes passengers connecting through another airport to reach their destination.

- Average One-Way Fare 2Q24: The average one-way fare paid by passengers on these connecting routes.

- YoY Pax Change: The percentage change in passenger volume year-over-year.

- YoY Fare Change: The percentage change in average fares year-over-year.

For consistency, the DOT groups nearby airports under metropolitan areas. For instance, the Washington, D.C., area includes IAD, DCA, and BWI airports, while Boston includes BOS, PVD, and MHT. This grouping can make certain markets appear larger than they would if individual airports were isolated.

Ishrion Aviation manually reviewed each market in descending order of passenger volume to verify the absence of non-stop service.

While extensive, the analysis may still contain minor inaccuracies, such as the potential inclusion of city pairs that have recently launched direct service or the omission of a few markets.

Here are the 100 Routes:

Key Unserved and Recently Added U.S. Routes

Several large unserved U.S. markets show high passenger demand but lack non-stop service. Key routes include:

- Milwaukee–Los Angeles: The largest unserved market, with 226 daily passengers. Both Spirit and Southwest previously offered this route.

- Milwaukee–San Francisco: United operated this route pre-COVID.

- Hartford–San Francisco: JetBlue recently canceled service here.

- Los Angeles–Savannah: Announced by Breeze in 2022 but canceled before its launch.

- Knoxville–Los Angeles: Under consideration by Breeze.

- Charleston–San Francisco: Previously served by Breeze.

In addition, nine significant routes have recently seen new or upcoming non-stop service, reflecting airline interest in high-demand markets:

- New Orleans–Portland: Alaska Airlines will begin this route (MSY-PDX) next year.

- Norfolk–Phoenix: Breeze recently launched the ORF-PHX service.

- Kansas City–Sacramento: Southwest recently began MCI-SMF service.

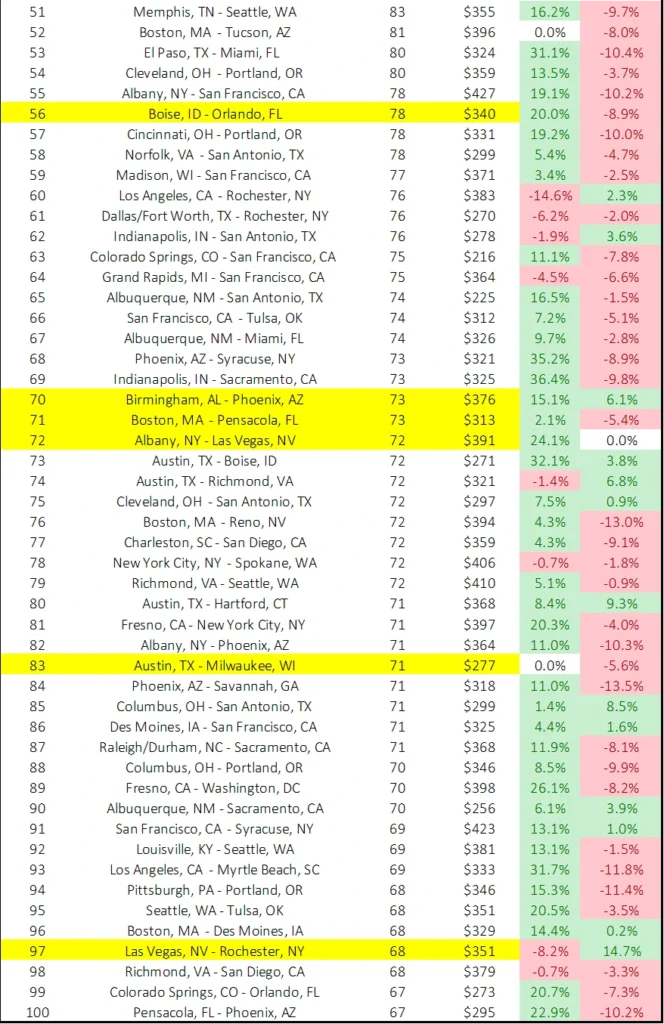

- Boise–Orlando: Alaska Airlines will soon start BOI-MCO service.

- Birmingham–Phoenix: Southwest recently launched the BHM-PHX service.

- Boston–Pensacola: Delta will soon begin BOS-PNS service.

- Albany–Las Vegas: Southwest recently launched the ALB-LAS service.

- Austin–Milwaukee: Southwest will begin the AUS-MKE service next year.

- Las Vegas–Rochester: Southwest recently launched LAS-ROC service.

Passenger Demand Data Doesn’t Guarantee Viability

Current passenger data between city pairs doesn’t fully indicate whether a new non-stop route would succeed. While passenger volumes offer insights, they don’t account for various factors influencing route viability, says ViewfromtheWing.

Not all routes require daily service; lower daily passenger averages don’t necessarily mean a route cannot operate. Flight schedules also vary, and one flight might not capture all potential travelers due to preferences, corporate contracts, frequent flyer programs, and other loyalty factors.

A new non-stop option could stimulate demand. For example, direct flights may encourage more frequent travel or prompt some travelers to opt for in-person meetings over virtual ones. Non-stop options can make day trips feasible, which would be impractical with connecting flights.

Additionally, regional airport groupings impact demand metrics. For instance, the Washington, D.C., area includes Dulles, National, and Baltimore, and not all travelers are willing to travel between these airports for non-stop options. Local geography affects potential traffic for any new route.

Market history also matters. Routes like Los Angeles to Milwaukee, previously served by Southwest and Spirit, may or may not sustain demand today, as the two airlines were previously unable to maintain service.

Bottom Line

Long travel times, whether by road or connecting flights, can lead travelers to drive instead. While driving offers flexibility, it’s more time-consuming, economically less efficient, and limits community access to essential services, family, and business networks.

Expanding non-stop flights, and bypassing major hubs, remains an essential policy goal. New technology, such as electric aircraft with short takeoff and landing capabilities, could make more direct routes viable from a broader range of locations.

However, this potential hinges on regulatory factors: large airlines and pilot unions must not stifle competition by blocking part 135 operations, which are crucial to enabling this expanded service.

Stay tuned with us. Further, follow us on social media for the latest updates.

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News