DALLAS- The World’s largest single aircraft type carrier, Southwest Airlines (WN) seems imbalanced as Boeing 737 MAX 7 delays have forced the airline to change its strategy.

The Texas-based carrier earlier placed a firm order for 288 737 MAX 7, 207 MAX 8, and 199 were options to go with -7 or -8. But it has recently converted some of its MAX 7 orders into MAX 8. Let’s see how this order swapping turning out for Southwest.

Southwest 737 MAX 7 Delays

As of March 31, 2024, the Dallas-based carrier had a total of 694 aircraft on order, encompassing firm orders and options. For 2024, the airline had planned for 85 deliveries, which included 27 737-7s and 58 737-8s. However, this number has significantly decreased due to internal issues at Boeing, which we are aware of.

Will Horton, the aviation analyst in his post explains this in detail. He posed the question, “Has Southwest lost its balance?”

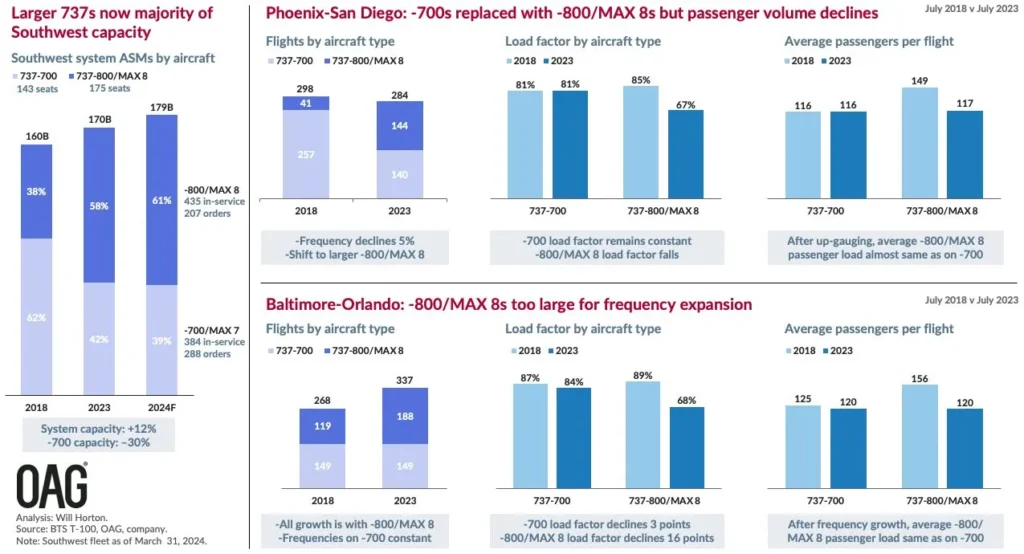

Delays in the MAX 7 deliveries have led Southwest to opt for MAX 8s instead. The -800/MAX 8 models now account for 61% of the airline’s capacity, a significant increase from 38% in 2018. However, the larger 737s face challenges in achieving high load factors and avoiding yield dilution in Southwest’s short-haul segments.

1. Challenges with Load Factor

Boeing 737 MAX 7 delays have prevented Southwest from maintaining an optimally sized fleet. The airline has been phasing out its older 737-700s, which were previously crucial, contributing 62% of ASMs in 2018. Due to ongoing MAX 7 certification delays, Southwest has been acquiring MAX 8s instead.

Between 2018 and 2024, the roles of the -700 and -800/MAX 8 have dramatically shifted. Now, the -800/MAX 8 models account for 61% of ASMs, according to OAG data.

The -800/MAX 8 aircraft have 32 more seats than the -700 (175 vs. 143). While the MAX 8 may have similar trip costs to the -700, this maintains rather than reduces the cost structure. Managing costs remains a significant challenge for Southwest.

This shift to larger aircraft has also coincided with declines in load factors and yield weaknesses.

2. Struggle on Some Routes

Phoenix (PHX)-San Diego (SAN): Southwest used to primarily operate -700s on this route. However, with the retirement of these aircraft and the absence of MAX 7s, Southwest has shifted to an almost even split between -700 and -800/MAX 8 models.

The -700 flights have maintained an 81% load factor. In contrast, the increased deployment of the -800/MAX 8 has seen their load factor drop to 67%. On average, the -800/MAX 8 flights carry 117 passengers, just one more than the average -700 flight.

Several factors, such as yields, aircraft availability (given the short distance), and directional variances, remain unclear. Public data does not provide load details for specific flights.

The low load factor for the -800/MAX 8 in 2023 is particularly noteworthy, considering it outperformed the -700 in 2018. This past performance might have been due to strategic aircraft allocation and effective yield management, or perhaps the limited deployment of the -800/MAX 8 in 2018 was a tactical decision.

Baltimore (BWI)-Orlando (MCO): Southwest has maintained the same number of -700 frequencies when comparing July 2018 to July 2023. To expand the market, Southwest added more -800/MAX 8 frequencies.

The load factor on -700 flights dropped slightly from 87% in 2018 to 84% in 2023. However, the -800/MAX 8 load factor fell significantly by 16 points, from 89% to 68%. On average, the -800/MAX 8 flights carry 120 passengers, the same as the -700 flights.

As with Phoenix-San Diego, the -800/MAX 8 outperformed the -700 when used less frequently, based on load factor. It appears that Southwest may not be ideally suited for such a large proportion of its capacity to be supplied by medium/large narrowbodies.

Bottom Line

Will finally concludes his insights and says, ‘Southwest is dealing with several challenges. While MAX 7 certification won’t solve everything, the deliveries of MAX 7 aircraft will assist Southwest in re-balancing its fleet. Currently, Southwest has more firm orders for the MAX 7 (288) than for the MAX 8 (207), though it retains the flexibility to interchange variants.’

‘Even if activist investor Elliott doesn’t manage to implement a specific change, it can likely still benefit once MAX 7 deliveries increase and competition from ULCCs decreases,’ added Horton.

Feature Image: Caden Henderson (@cado.photo) • Instagram photos and videos

Join us on Telegram Group for the Latest Aviation Updates. Subsequently, follow us on Google News.